Full-Service Payroll Designed

For Your Business

Payroll may seem like just writing a check but there is so much more to it than that and every business has different payroll needs. At O2 we live and breathe payroll so you never have to. We keep you up-to-date whenever regulations change. O2 relieves you of your payroll responsibilities so you can spend your time focused on running your business.

Why Do You Need A

Full-Service Payroll?

Payroll seems simple but it is so much more than writing a check. Payroll also means knowing the rules surrounding overtime, premium pay, job costing, certified payroll, and salary requirements. It also means unemployment claims, annual tax statements or W2s and garnishments. That is just the beginning. Outsourcing your payroll is critical for ensuring that you stay in compliance in all areas of payroll, a task that can be overwhelming for business owners and managers.

Managing More

Than Paychecks

Our payroll services include all aspects of your payroll from beginning to end. This means reviewing time cards, ensuring timely payment, accurate calculations, tracking accruals, filing all state and federal taxes, processing garnishments and so much more. The rules surrounding payroll and the numerous tasks that come with it are more complicated than they seem at first and making a mistake can be more costly than ever. There are few things that are more important to your employees than getting their paychecks to them on time and accurately.

Convenience Of Using

Our Service

When you use the experts at O2, you know that you are covered for payroll compliance. The last thing you want is to pay fines and penalties for a simple mistake or not complying with a rule you weren’t even aware of. We make it simple and easy for you. You turn in the hours and we do the rest. If there is an issue or change that needs to be made, we let you know, help you develop the policies and make sure your employees understand as well.

Overseeing All Compliance Requirements

We Handle Liabilities With The

IRS And All Tax Requirements

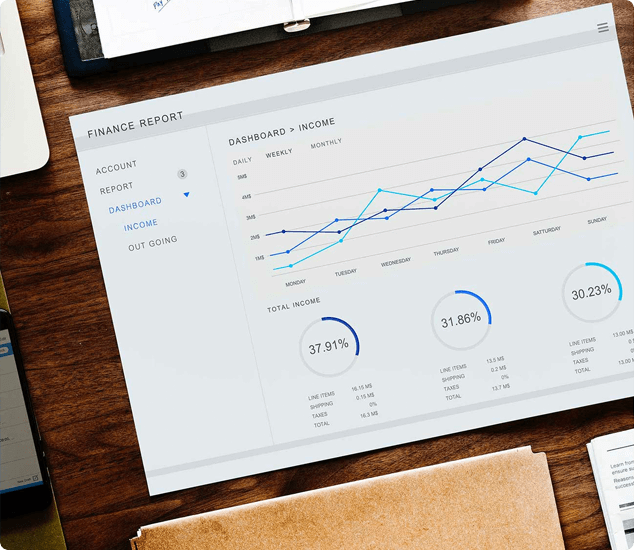

Benefits Of Utilizing

Our Reports

Whether you need to job cost, see your payroll by position or location, or determine how your payroll is allocated by department, we can provide the reports you need to oversee it all. We know the importance of investing in technology and keeping up with the changing market. It is our mission to provide you with cutting edge tools at your fingertips to make your job as an employer easier than ever.

Managing All Reports And Giving You More Insight

In addition to all the standard payroll reports, we can customize reports to meet all your needs. Each business has different requirements and specifics they are looking for and we will make sure you have them.